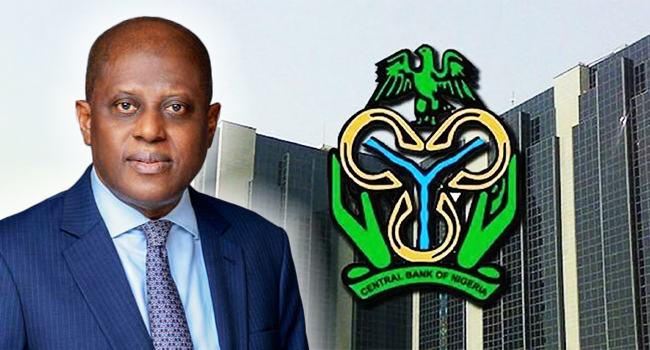

Central Bank of Nigeria (CBN) don ban di use of foreign currency as collateral for naira loans, except for Eurobonds wey Federal Government issue or guarantees from foreign banks, like Standby Letters of Credit.

According to di new rule wey CBN Acting Director of Banking Supervision Department, Adetona Adedeji, direct give all banks, dem no fit accept deposits wey dey in foreign currencies like USD, EUR, or GBP as security for loans wey dem give for Naira. Di ban extend to most financial instruments wey dey based on foreign currency, apart from those wey CBN don specifically allow.

Di apex bank also announce say dem go sell $10,000 to each of di 1,588 BDC operators to meet retail market demand for eligible transactions.

One statement wey dem release yesterday talk say dem go sell am at di rate of N1,101/$1, make dem sell to eligible customers at a spread wey no pass 1.5 per cent above di purchase price.

Di listed eligible BDCs don receive order make dem begin pay di naira deposits into four CBN accounts, wey go start from April 8, 2024, and dem ask operators make dem submit evidence of payment and other documents for di correct CBN branches make dem share am.